Empty Container Management – Latest

We’ve devoted this update to the latest information on empty container management across Australia.

Empty container management is a vital component of the efficiency of any container port. However, many challenges arise, access pricing is skyrocketing, and the cost of managing empty containers through the supply chain is increasing.

Landside logistics operators bear the initial brunt of these cost increases, and ultimately they impact on import and export supply chain competitiveness.

Increasing Notification Fees:

Recently, there has been a plethora of announcements in Melbourne, Sydney, Brisbane, Adelaide and Fremantle of significant increases in Empty Container Park (ECP) Notification Fees paid by road transport operators for truck arrival notification slots.

Trucks must have a notification slot to either de-hire an empty import container or pick up an empty export container from an ECP. Otherwise, the truck will not be serviced.

Here is a compiled list of the recent announcements (as at 17 August), which can be downloaded: Here

Prior to January 2019, ECP Notification Fees ranged between $11.00 (+GST) to around $20.00 (+GST) depending on the port and the ECP. Taking into account the latest increases being implemented in early September, in less than two years, ECP Notification Fees will have increased in the range of 268% to 590%, with the highest fee now being $65.00 per Notification.

Some increased fees (but not all) have been accompanied by announcements of additional capacity, increased opening times, investments in new empty handling equipment, and some flexibility in truck arrival times around the booked time zone without financial penalty. (Capacity issues are discussed in greater detail below).

Pseudo Infrastructure Fees:

Along with the significant increases in Notification Fees over the last eighteen months has been aggressive contract negotiations by shipping lines with Empty Container Park (ECP) providers in all ports.

It’s estimated that prior to the beginning of 2019, ECP revenue generated from shipping lines for empty container services was circa $120.00 per container. Today, ECP shipping line revenue is estimated to be closer to $80 per container. In addition, the increased volumes of Direct Return of Empties (DRE) to stevedore terminals have impacted on traditional ECP revenue.

As stevedores apply ever increasing and unregulated terminal access fees (infrastructure charges) to make up for lost revenue from shipping line contracts, now a sizable element of ECP Fees can be characterised as infrastructure / access charges so that ECPs remain competitive in shipping line contract negotiations.

ECP Capacity

Empty Container Park (ECP) capacity constraints have been most keenly felt in Sydney (Port Botany).

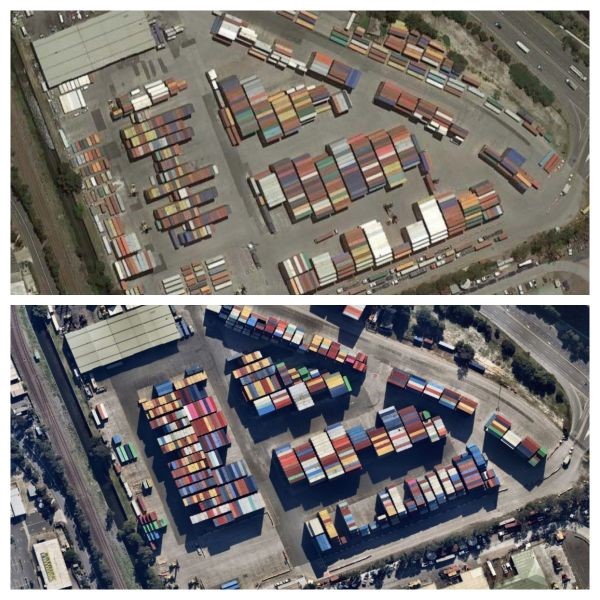

Here is a compiled montage of aerial images of prominent ECPs servicing trade through Port Botany, showing “then” photos from Google Maps, and “now” photos sourced at the beginning of August. Pictures paint a 1000 words! The congestion levels are obvious – see: Here

Some ECP capacity has been added in Port Botany in recent weeks and months.

A new park has been leased by Tyne Container Services (operating 24/7), adjoining the existing Tyne (MT Movements) park, effectively ‘super-sizing’ the site, delivering an additional 5,000 TEU in empty container capacity.

Last week ACFS also opened e-Depot 2 in Port Botany, creating a welcomed additional capacity of 4,500 TEU. This development came together at short notice after a strong collaborative effort by ACFS Port Logistics and NSW Ports.

However, empty handling capacity in Sydney will be further reduced in the coming month with the closure of Tyne St. Peters, while planning clouds remain over the largest empty facility in NSW, Qube Cooks River Intermodal Terminal (CRIT), given that the NSW Government doesn’t seem to be listening to the industry’s concerns about adequate truck connections at Canal Road onto the Sydney Gateway Project (see: Here).

What are the reasons for the congestion?A major reason for severe empty container constraints in Sydney in the last few months has been a reduction in the number of full exports and empty export repositioned by shipping lines relative to import discharges.

An analysis by NSW Ports has identified an imbalance of over 30,000 TEU between full & empty exports and full & empty imports between April to June 2020.

Several factors have contributed to this situation, including weather disruptions, berth congestion due to vessel bunching, vessel rotation changes (some vessels even bypassing Sydney), congested stevedore Direct Return of Empties (DRE) pools, and stevedore industrial disputation affecting empty bulk run receivals.

The lack of ECP capacity has led to a marked increase in empty container redirections ordered by shipping lines. As of last week, there were over 100 redirection messages live in Sydney, with instances where some container types for various shipping lines were redirected up to five times before a de-hire location was settled.

Redirections have a significant cost impact on transport operators (see section below on performance & costs).

Overall ECP capacity constraints aren’t being experienced in the other major capital city ports to the same extent as Sydney.

However, where congestion and delays can and do occur, in Melbourne and Brisbane particularly, is when shipping lines insist that empty import containers must be de-hired to only one facility, without providing any viable alternative to importers and their transport providers. Unacceptable lengthy truck queuing delays then result if the nominated facility has no capacity to match the demand.

It is imperative that all parties in the container logistics chain work collaboratively to improve productivity levels and information exchange to assist in countering the negative impact of physical ECP capacity restraints.

Performance & Costs

Added Costs for Transport Operators:

Congestion at Empty Container Parks (ECPs), at stevedore terminals for Direct Return of Empties (DRE), and constant re-direction of empties between one facility and another have significant cost implications for container transport operators:

- A lack of available container slots for the return of empties;

- The need to stage empty containers through transport yards, including the costs of additional container lifts and yard storage;

- Additional truck kilometres travelled – made worse by constant re-directions;

- Longer Truck Turnaround Times (TTT), leading to the danger of the truck missing its subsequent time slot in another part of the supply chain and incurring penalties there;

- Added risks of No Show fees and other penalty regimes;

- Time delays which threaten the ability of transport operators to ensure that import empty containers are de-hired within container detention free times, and subsequent invoices from shipping lines to importers for container detention.

- Added administration costs.

What’s being done about these issues in each State?

Transport for NSW has already calculated that inefficiencies and delays in empty container management costs the economy over $49 million per year, which could rise to over $100 million if nothing is done about it (see: Here)

In NSW, CTAA is advocating strongly for change and performance improvements through the recently convened NSW Empty Container Working Group, a sub-group of the NSW Port Transport Logistics Taskforce (PTLT).

The matters being pursued through the Working Group include:

- Key performance data measurement, including empty container slot supply and demand at ECPs and stevedore terminals across all time zones, slot take-up statistics, truck arrival patterns, and truck turnaround times.

- The number of redirections, and how these can be better managed through greater notice, and the honouring of valid slot notifications made prior to a redirection being called.

- The percentage of electronic messaging from shipping lines with de-hire information, which has been below 40% in Sydney. There are still several shipping lines that provide zero electronic data, which impacts information visibility and efficiency.

In Victoria, the Government was pursuing a Voluntary Port of Melbourne Performance Model (VPPM). However, these developments have been overshadowed by Victoria’s response to the COVID-19 pandemic.

In Fremantle, empty container management issues are dealt with comprehensively through the WA Port Operations Taskforce convened by Fremantle Ports.

In Brisbane, there is far more work to be done on the inefficiencies in the empty container management chain. CTAA is currently liaising with the Queensland Government and the Port of Brisbane regarding these issues and how greater attention can be applied to seek improvements.

Improvements in empty container management efficiencies are more important than ever before, particularly given the significant increases in ECP Notification Fees which become a cost burden for all in the landside container logistics chain.

Kind Regards,

SILA Global